Leasing a ship can be a strategic and cost-effective decision for maritime businesses. Whether you’re looking to scale your operations quickly, manage financial risk, or access the latest technology, leasing offers numerous advantages over purchasing. Here are 22 compelling reasons why leasing might be the best option for your company.

1. Cost-Effective Capital Allocation

Leasing a ship allows companies to allocate their capital more effectively. Instead of investing a significant amount of money upfront to purchase a vessel, leasing spreads the cost over time. This approach frees up capital for other investments or operational needs, enhancing overall financial flexibility.

2. Access to the Latest Technology

Leasing agreements often include modern and well-maintained vessels equipped with the latest technology. This access ensures that your operations benefit from improved efficiency, safety, and compliance with the latest environmental regulations without the need for constant upgrades and retrofits.

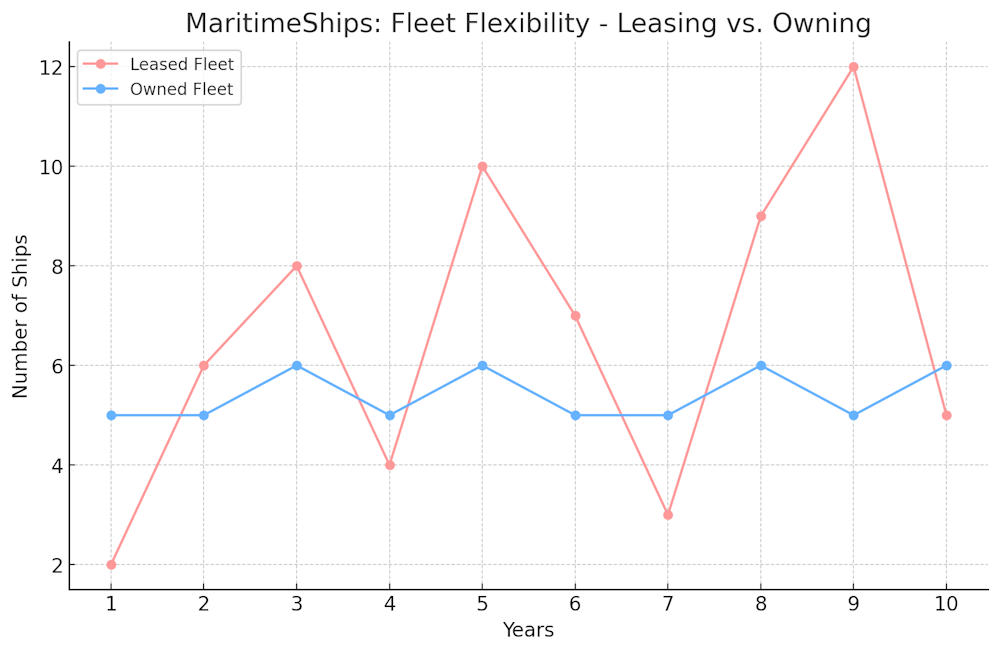

3. Flexibility in Fleet Management

Leasing provides unmatched flexibility in managing your fleet. Companies can adjust the size and composition of their fleet based on market demands and operational needs. Whether you need to scale up during peak seasons or scale down during off-peak times, leasing offers the agility to respond swiftly to market changes.

4. Reduced Maintenance and Repair Costs

When leasing a ship, the lessor often handles maintenance and repair responsibilities. This arrangement not only reduces the burden on your company’s resources but also ensures that the vessel is always in optimal condition. Predictable maintenance schedules and reduced downtime contribute to more efficient operations and cost savings in the long run.

5. Mitigation of Market Risks

Leasing ships helps companies mitigate market risks associated with owning vessels. Fluctuations in the shipping market, such as changes in demand, freight rates, and fuel prices, can impact profitability. Leasing provides the flexibility to adjust fleet size and composition in response to these market conditions, reducing financial exposure.

6. Tax Advantages

Leasing can offer significant tax benefits. Lease payments are often considered operating expenses, which can be deducted from taxable income. This deduction can improve the company’s cash flow and overall financial health. Additionally, certain leasing structures might provide further tax incentives, depending on local regulations.

7. Avoidance of Depreciation

Ships, like all assets, depreciate over time. By leasing instead of purchasing, companies avoid the depreciation costs associated with ownership. This avoidance not only preserves the vessel’s value on your balance sheet but also eliminates the risk of having to sell a depreciated asset in the future.

8. Easier Budgeting and Financial Planning

Leasing agreements typically involve fixed monthly payments, making it easier for companies to budget and plan their finances. Predictable costs enable better financial forecasting and reduce the uncertainties associated with variable expenses. This stability is especially valuable for businesses with tight budgets or those looking to maintain steady cash flow.

9. Access to a Variety of Vessel Types

Leasing provides access to a wide range of vessel types and sizes without the long-term commitment of ownership. Whether you need a container ship, tanker, bulk carrier, or specialized vessel, leasing allows you to select the right type of ship for your specific needs. This flexibility ensures that you always have the appropriate vessel for your operations.

10. Improved Cash Flow Management

Leasing ships helps improve cash flow management by spreading the cost of the vessel over the lease term. This approach avoids large, upfront capital expenditures and allows for better allocation of resources. Enhanced cash flow management supports overall business stability and growth, enabling companies to invest in other critical areas.

11. Enhanced Operational Efficiency

Leasing agreements often come with comprehensive support services from the lessor, including crew management, maintenance, and insurance. These services enhance operational efficiency by reducing the administrative burden on your company. With the lessor handling these aspects, your team can focus on core business activities and strategic initiatives.

12. Strategic Partnerships with Lessors

Leasing ships can foster strategic partnerships with lessors, who often have extensive industry knowledge and resources. These partnerships can provide valuable insights, market intelligence, and access to a network of industry contacts. Leveraging the expertise of a reputable lessor can enhance your company’s competitive edge and operational effectiveness.

13. Scalability for Business Growth

Leasing ships allows for scalability, accommodating both business expansion and contraction as needed. If your business experiences growth, you can lease additional vessels without the long-term commitment of purchasing. Conversely, if market conditions require downsizing, you can easily return leased vessels at the end of the lease term, minimizing financial strain.

14. Access to Global Markets

Leasing can provide access to vessels that are already compliant with various international regulations and standards, enabling you to enter new global markets more quickly and efficiently. This access helps you expand your business footprint without the delays and costs associated with modifying or retrofitting owned vessels to meet different regulatory requirements.

15. Improved Risk Management

Leasing can improve risk management by transferring certain risks associated with ship ownership to the lessor. These risks include market volatility, maintenance uncertainties, and residual value risks. By leasing, your company can focus on operational performance and strategic initiatives, while the lessor manages the inherent risks of asset ownership.

16. Enhanced Fleet Modernization

Leasing enables companies to modernize their fleet more frequently. As technology and regulations evolve, leasing allows for easier upgrades to newer, more efficient, and environmentally-friendly vessels. This approach helps maintain a competitive edge in the market, ensuring your fleet remains state-of-the-art without the financial burden of constant capital expenditures.

17. Easier Compliance with Environmental Regulations

Leasing ships often means having access to newer vessels that comply with the latest environmental regulations. As global shipping regulations become stricter, leasing can help your company stay compliant without the need for costly retrofits or replacements. This compliance reduces the risk of penalties and supports your company’s sustainability goals.

18. Customized Leasing Agreements

Leasing agreements can be tailored to meet your specific needs. Whether you require short-term charters, long-term leases, or options to purchase at the end of the lease, customized agreements offer flexibility. This customization ensures that the terms align with your operational and financial goals, providing a bespoke solution for your business.

19. Access to Specialized Vessels

If your operations require specialized vessels, leasing can be an excellent option. From icebreakers to offshore support vessels, leasing allows you to access the exact type of vessel needed for unique projects without the long-term investment. This access ensures you can meet specific operational requirements efficiently and cost-effectively.

20. Operational Continuity

Leasing can ensure operational continuity during periods of fleet transition or expansion. If your business is in the process of upgrading or expanding its fleet, leasing provides a seamless way to maintain operations without disruption. This continuity is crucial for meeting customer demands and maintaining market presence during periods of change.

21. Strengthened Competitive Advantage

Leasing ships can strengthen your competitive advantage by allowing you to quickly respond to market opportunities. With the ability to scale your fleet up or down and access the latest technology and specialized vessels, your company can remain agile and ahead of competitors. This responsiveness enables you to seize new opportunities and maintain a strong market position.

22. Simplified Exit Strategy

Leasing provides a simplified exit strategy compared to owning vessels. If market conditions change or your business model evolves, terminating a lease is generally more straightforward than selling a ship. This ease of exit allows your company to adapt to new circumstances without the complexities and potential losses associated with divesting owned assets.

In conclusion, leasing ships provides unparalleled flexibility, financial benefits, and operational advantages that can significantly enhance your maritime business. From mitigating market risks and ensuring compliance with regulations to enabling fleet scalability and preserving capital, the reasons to lease are clear and compelling. By choosing to lease, you position your company for sustained growth and adaptability in a dynamic industry.